31 Mag MIMS – Diversified Passive Selection Fund (Report May 2023)

The fund is composed of a range of Exchange Traded Funds selected by the Portfolio and Quantitative Research (Risk) teams. These ETFs aim to replicate as closely as possible the performance of a basket of securities with specific common properties, thus being effective instruments for investors who wish to express a certain view on industry sectors or economic trends whilst capturing as little idiosyncratic risk as possible.

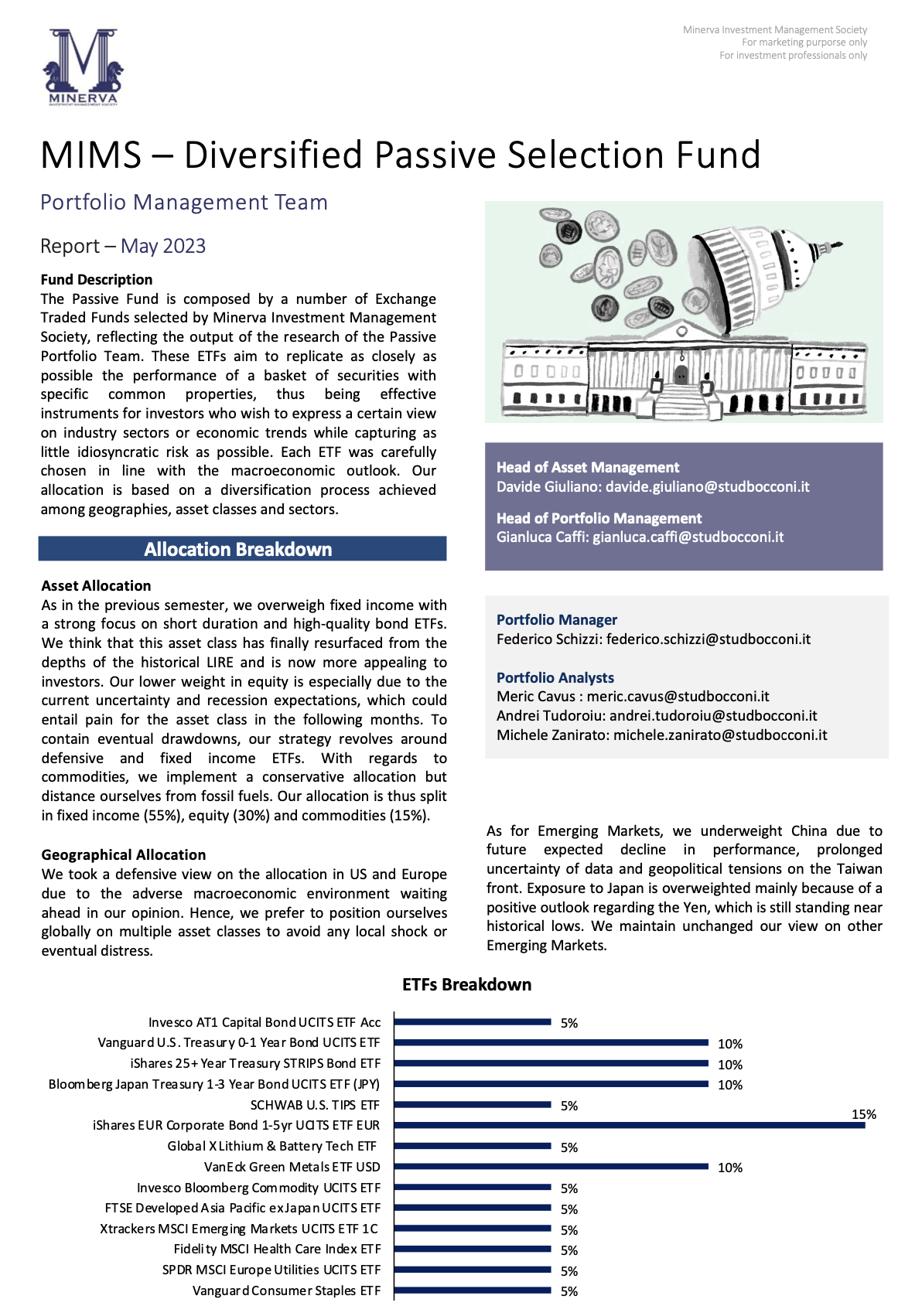

Our final report for this semester presents a conservative asset allocation, with an increased exposure to fixed income and a more cautious view on equity and commodities. Among the new entries, the team chose an ETF on European Banks AT1 Contingent Convertibles, which are deemed to bring a positive risk-return profile in light of the recent banking turmoil, and another one on US ultra-long duration bonds to hedge against the risk of a severe economic downturn that in their opinion will trigger a rapid cut in interest rates. Finally, the team has a positive view on APAC ex-China, particularly on Japan.

Download PDF