02 Giu Cadence Design Systems – Equity Research

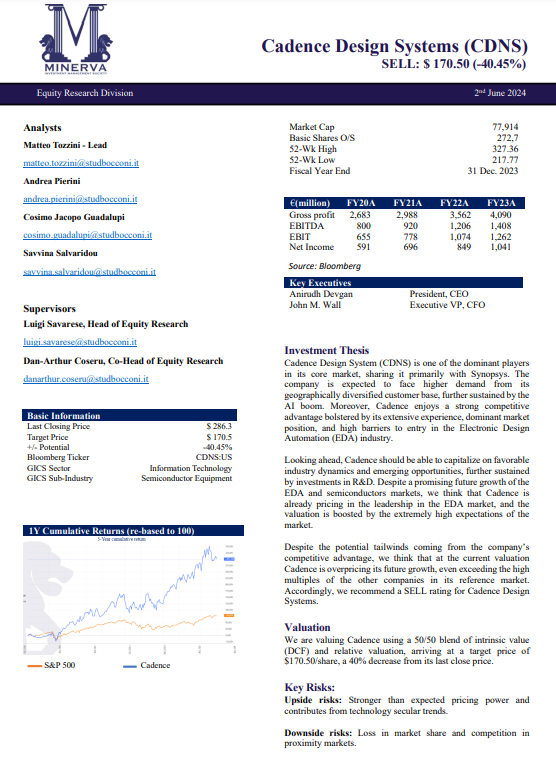

Our Equity Research team has just released its third analysis for this semester! The company analysed in our equity research report is Cadence Design System (CDNS). The company is one of the dominant players in its core market, sharing it primarily with Synopsys. The company is...