14 Dic WeBuild S.P.A. – EQUITY RESEARCH

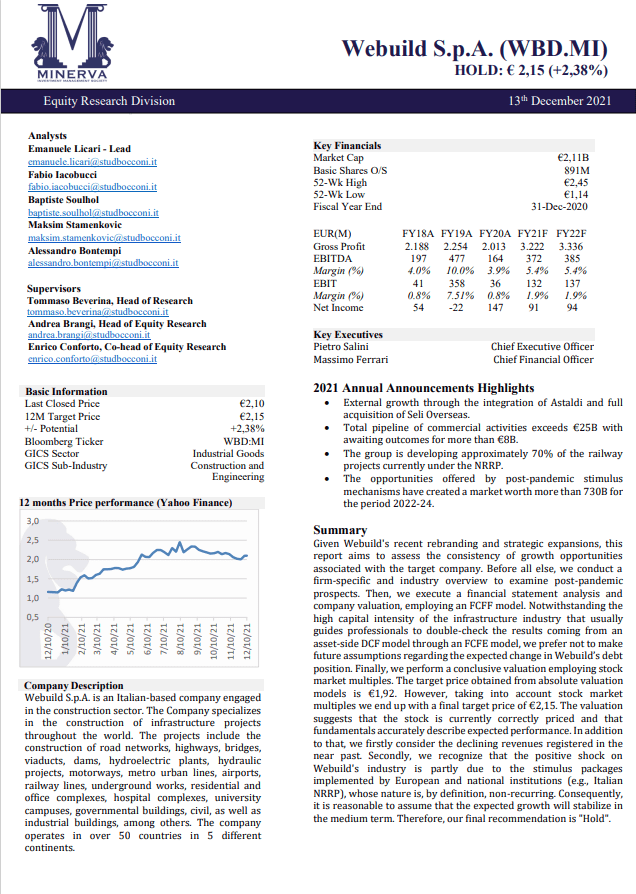

Webuild S.p.A. is an Italian-based company engaged in the construction sector. The Company specializes in the construction of infrastructure projects throughout the world. The projects include the construction of road networks, highways, bridges, viaducts, dams, hydroelectric plants, hydraulic projects, motorways, metro urban lines, airports, railway...